This page details the steps to configure Gift Aid Recorder and Epos Now when operating Gift Aid on Admissions.

Account Settings – Gift Aid Recorder

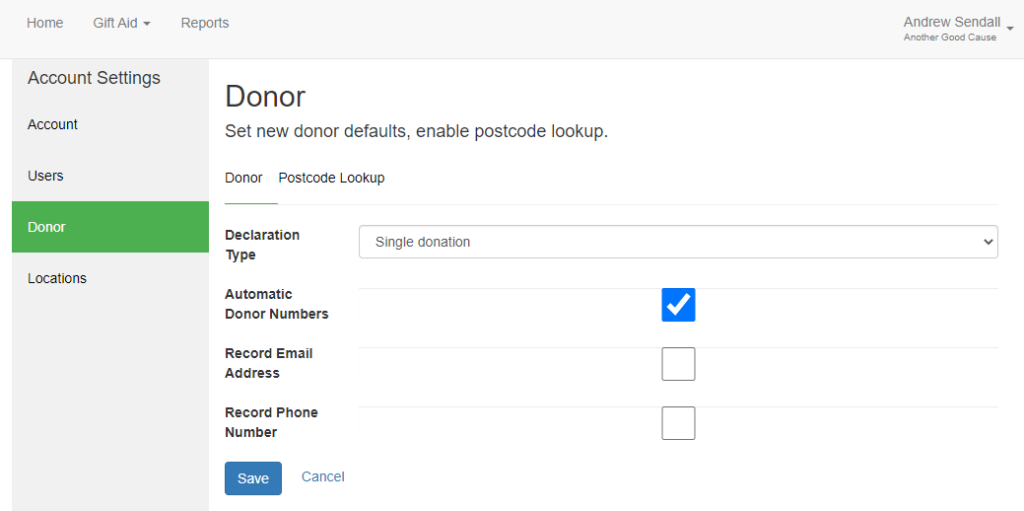

- Go to Account Settings > Donor

- Set values for:

- Declaration Type (Specifies the default declaration type for new donors. For Gift Aid on Admissions choose Single donation or Multiple donations)

- Automatic Donor Numbers (When checked the New Donor Wizard will not prompt for a Donor No.)

- Record Email Address (When checked the New Donor Wizard will request an email address)

- Record Phone Number (When checked the New Donor Wizard will request a phone number)

- Click Save

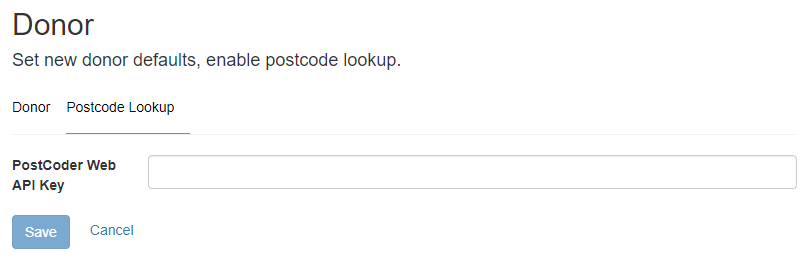

Postcode lookup – Gift Aid Recorder

- Select the Postcode Lookup tab

- Enter your PostCoder Web API Key (Leave blank to enter addresses manually)

- Click Save

Postcoder is a third party service provided by Allies Computing. For more details visit https://postcoder.com/address-lookup.

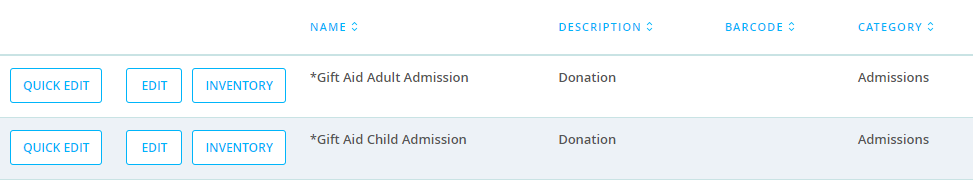

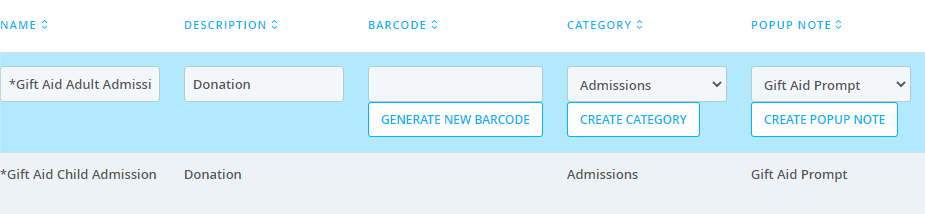

Configure qualifying Gift Aid Products – Epos Now

In order for Gift Aid Recorder to recognise admission charges which qualify for Gift Aid the associated Epos Now products must include the word “Donation” in the product description.

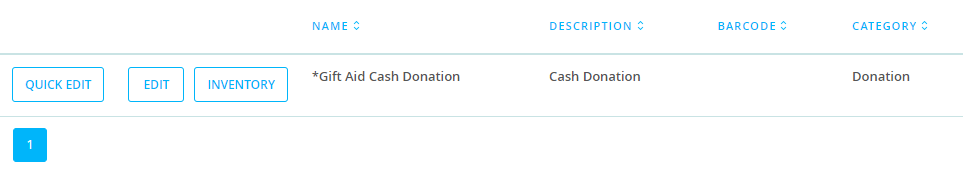

The phrase “Cash Donation” is reserved for identifying cash donations. For cash donations set up an Epos Now product with the “Variable Price” option and include the phrase “Cash Donation” in the description.

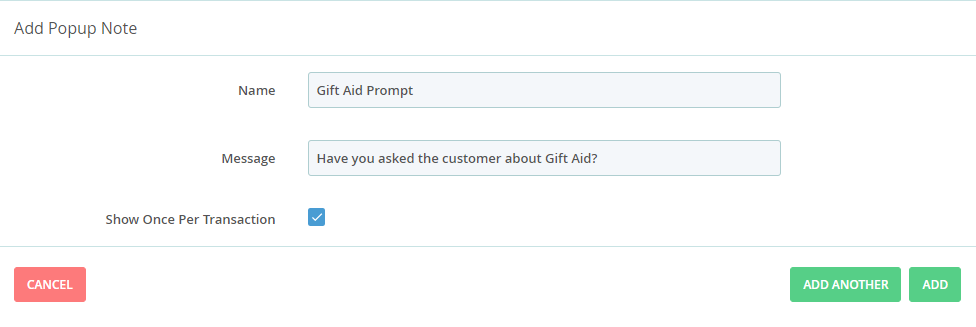

Setting up a Popup Note – Epos Now

It can be useful to setup a popup note to remind till operators about Gift Aid.

- From the menu choose Manage – Products – Popup Alert

- Click ADD POPUP NOTE

- Set the name to something recognisable e.g. Gift Aid Prompt

- Set the message e.g. “Have you asked the customer about Gift Aid?”

- Check “Show Once Per Transaction”

- Click ADD

Edit your Gift Aid qualifying products to reference the new Popup note.

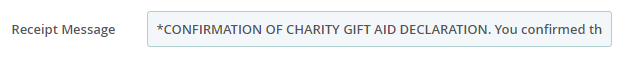

Configuring a Receipt Message – Epos Now

- From the menu choose Setup – Company – Receipts

- Edit the Receipt Message to meet the Gift Aid requirements

Example Message: *CONFIRMATION OF CHARITY GIFT AID DECLARATION. You confirmed that you are a UK taxpayer and that you understand that if you pay less Income Tax and/or Capital Gains Tax in the current tax year than the amount of Gift Aid claimed on all your donations it is your responsibility to pay any difference. You are entitled to cancel your Gift Aid declaration any time within 30 days.

Note: This message will print on every receipt. You could opt to attach the receipt to pre-printed Gift Aid terms and reference this in the Receipt Message with an asterisk to identify qualifying items.