If you are operating retail Gift Aid you must go through the notification process before generating a claim. Until the notification process is complete any generated claim will not include additional sales i.e. sales above the threshold (Method A £100).

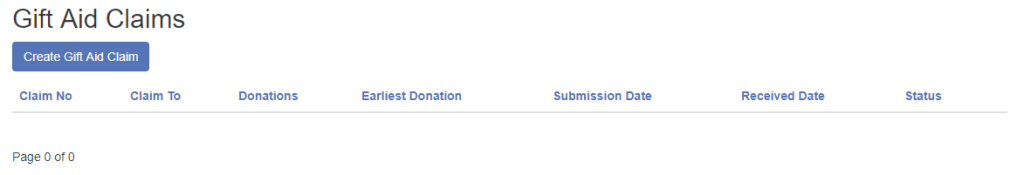

To create a Gift Aid claim use the menu system to navigate to Gift Aid – Gift Aid Claims.

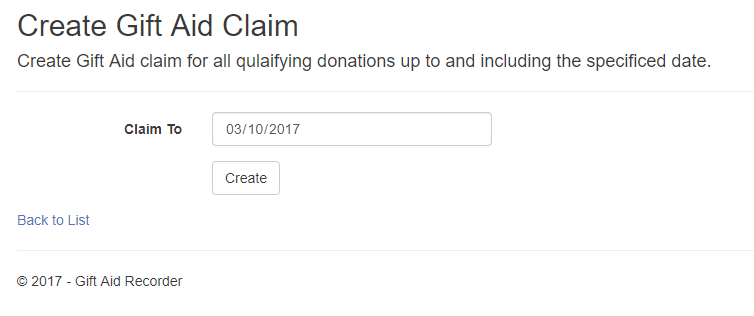

Click the ‘Create Gift Aid Claim’ button. On the ‘Create Gift Aid Claim’ form specify the ‘Claim to’ date and click ‘Create’.

Note: Gift Aid Recorder will add to the new claim, all qualifying donations with a donation date on or before the ‘Claim to’ date, excluding donations which have already been assigned to a claim.

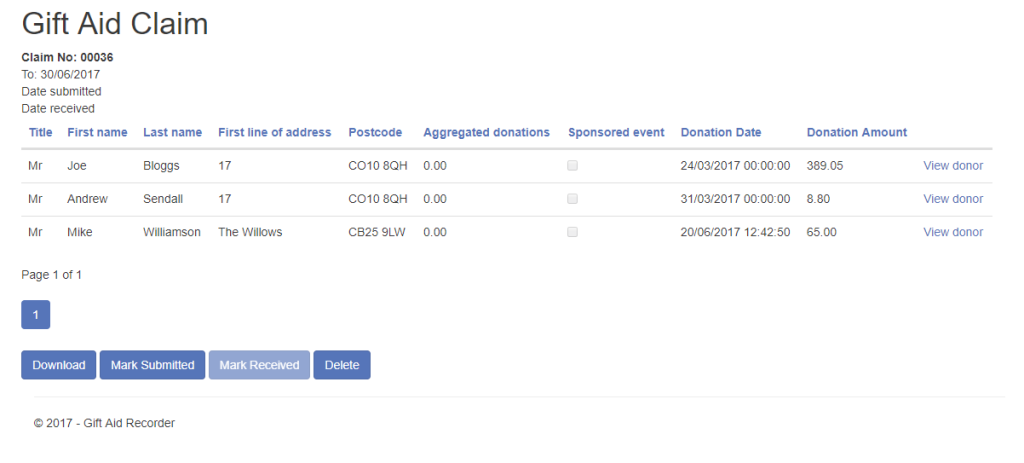

You will be returned to the Gift Aid Claims list. It may take some time for the claim to process. When it has completed you will be able to click the green ‘View’ button to see the claim details.

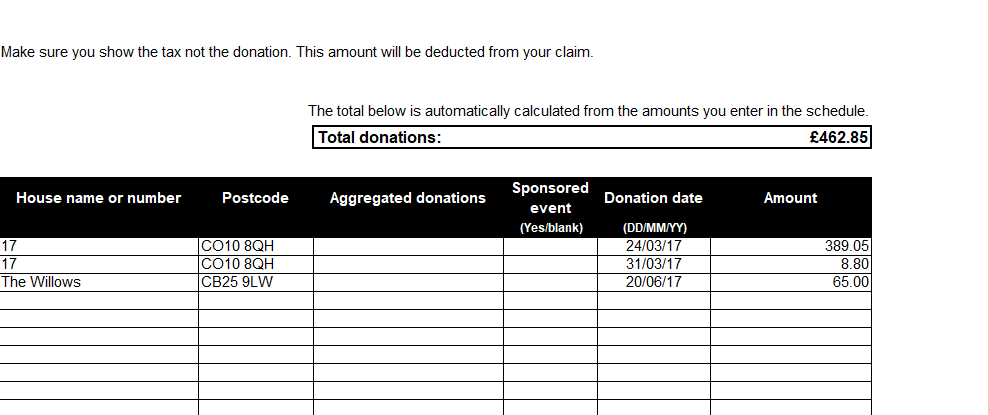

Click ‘Download’ to download the claim as an HMRC ‘ODS’ format claim spreadsheet. ODS files can be opened with OpenOffice or MS Excel if it has the OpenXML/ODF Translator Add-in.

The spreadsheet can be submitted directly to HMRC through the HMRC web portal here.

When you have submitted the claim return to the ‘Gift Aid Claim’ view in Gift Aid Recorder and click ‘Mark Submitted’. When you have received payment from HMRC return to the Gift Aid Claim once again to click ‘Mark Received’.

Note: Once you have marked the claim submitted you will no longer be able to delete the claim.